Earlier this year we looked at how software valuations, having surged during the pandemic to a sector-wide peak of nearly 10x forward revenues in 2021, had been reined back in to pre-pandemic levels, even before Russia’s invasion of Ukraine. In the six months since, many of the macro headwinds apparent at the start of the year have intensified: interest rates continue to rise at an unprecedented pace and inflation in both the US and Europe is hovering at close to 10%, a 40-year high. The spread on yields and forecasts from a variety of sources point towards a recession.

Software revenue multiples have settled into a newly established band in the mid-single digits, following their steep decline in the first half of the year

Despite this, software valuations have settled into a newly established band around c.5x forward revenues, following their steep decline in the first half of the year. Although it may be too early to definitively call the bottom of the market, we can start to identify segments of the software sector that have remained most resilient and attractive to investors.

Investors’ changing priorities

Firstly, and perhaps surprisingly, there has been a convergence between the pricing of software companies in North America and those in the rest of the world. North American software companies had historically enjoyed a premium of c.10% up until 2021, which has now disappeared. Part of this can be attributed to a recent increase in acquiror interest in some of the biggest names in Europe’s smaller and shallower pool of publicly listed software companies, which has fuelled share price increases and softened the impact of the broader software market decline. In the UK alone, where the pound sterling has weakened considerably against both the US dollar and the Euro over the last six months, two of the top five software companies by market capitalisation (Aveva and Micro Focus) are currently under offer and two (Darktrace and GB Group) were recently the subject of a takeover attempt.

We have seen a continued shift away from the ‘growth at all costs’ mentality and a ‘flight to quality’ towards higher-margin stocks

Secondly, we have seen a continued shift away from the ‘growth at all costs’ mentality and a ‘flight to quality’ towards higher-margin stocks. The correlation between the forward EV / revenue multiple and revenue growth, which peaked above 60% in the second half of 2020, is now at 42%, which is its lowest level since 2019. Conversely, the correlation between forward revenue multiple and a ‘rule of’ metric (i.e. the sum of revenue growth and EBITDA margin) has increased to 52% after having bottomed out at just 10% in 2021. In short, a combination of growth and profitability has now become a stronger factor in determining software valuations than revenue growth alone.

Sub-sectors combining the benefits of high margins, inflation-busting growth and mission-criticality have performed relatively better than others

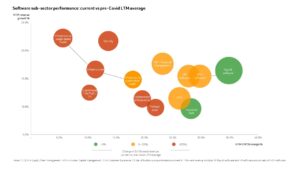

Finally, we can trace marked discrepancies in the performance of different sub-sectors within software. While investors continue to prefer “mission-critical” sub-sectors where the cost of displacement is high, it is no longer the only criterion. Sub-sectors combining mission-criticality with high margins and inflation-busting (i.e. double-digit) growth, such as Payroll software, Industrial tech and Supply Chain Management software, have performed relatively better than others when comparing current valuations to pre-Covid levels.

Infrastructure software surprisingly appears to have performed relatively worse despite its mission-critical nature. However, digging deeper and splitting this group by revenue model into subscription-based and usage-based pricing reveals an interesting dynamic: infrastructure software companies with a usage-based pricing model have performed considerably worse (45% below their pre-Covid average multiple) than their subscription pricing counterparts (just 13% below).

Security, which includes a disproportionately larger number of high growth but unprofitable companies, has been severely penalised as a category by the aforementioned ‘flight to quality’. Splitting this group into “low margin” (EBITDA margin < 15%) and “high margin” (EBITDA margin >15%) companies illustrates the ‘flight to quality’ more clearly: the “low margin” sub-group is trading 37% below its pre-Covid average, while the “high margin” sub-group is trading 12% above its pre-Covid average.

Vertical apps, which includes a broad group of vertical-specific software providers, has fallen by 21% compared to its pre-Covid average multiple. Within this group, companies serving the BFSI (Banking, Financial Services and Insurance) sectors have performed considerably worse, having fallen 28% below their pre-Covid average due to macro headwinds and recessionary fears that tend to disproportionately impact this sector. On the other hand, companies serving non-cyclical verticals such as public sector, defence and education, have proven to be much more resilient, trading at c.9% above their pre-Covid average, driven by sustained government investment in IT infrastructure transformation.

Similarly, within the HCM (Human Capital Management) software group, companies with use cases critical to business operations, such as payroll software, have significantly outperformed other HR and talent management software companies that are deemed to be less “mission-critical” in comparison.

The global financial crisis of 2008 offers the most relevant benchmark: software valuations declined by 53% from September 2007 to November 2008, and it took approximately ten quarters to recover

Drawing historical comparisons

While it is impossible to predict what the future holds, looking at historical market behaviour provides some interesting insights. If we look at the last five ‘corrections’ in software valuations (i.e. periods when the forward revenue multiple declined by 15% or more within six months), it took, on average, just over three quarters for the market to recover to its previous peak from the bottom. The global financial crisis of 2008 offers perhaps the most relevant benchmark for comparison, given the relative scale of valuation decline. Software valuations fell by 53% from September 2007 to November 2008, and it took approximately ten quarters (from November 2008 until February 2011) for multiples to recover to within five percent of their September 2007 peak. It is also worth noting that despite the recent decline, software valuations today remain well above the levels preceding the global financial crisis; the median EV / forward revenue multiple trough over the last 12-month period of 4.3x is significantly above the peak multiple in 2007 of 3.0x.

What this means for software investors in the short-term

With these considerations in mind, we believe the current market conditions will temper the mid-term enterprise software growth cycle slightly, but the long-term structural tailwinds will persist for decades. Hence, we see the current valuation environment to be primarily impacted by inflation and interest rates, which are widely expected to peak in 2023. As the interest rate environment stabilises in the second half of 2023 and beyond, we expect a gradual recovery in multiples over a period of time. The secondary knock-on impact will come from the IT spending environment being impacted by the upcoming recession, but we expect this to be short-lived and very sub-sector and vertical-specific. Companies with a combination of robust profit margins, stable growth, mission-critical technology and subscription-based recurring revenue models will be best positioned to weather the storm.