Read Arma’s view on how SoftBank’s acquisition of ARM has focused attention on the Internet of Things and the long-term paradigm shift that it will help usher in, while obscuring the extent to which enabling interconnected devices is already driving deal activity among financial sponsors, in full on Forbes here.

SoftBank chief exec Masayoshi Son identified capturing “the very significant opportunities provided by the Internet of Things”, the network of interconnected, internet-enabled devices set to grow exponentially in the coming years, as the primary driver for the $32bn acquisition of ARM Holdings.

The greatest significance of SoftBank’s $32bn acquisition of ARM Holdings need not be framed in terms of the attractiveness of the UK market to foreign buyers post-Brexit referendum or the loss of British tech businesses to bigger overseas acquirers, but as a catalyst for the emergence of the Internet of Things.

SoftBank chief exec Masayoshi Son identified capturing “the very significant opportunities provided by the Internet of Things”, the network of interconnected, internet-enabled devices set to grow exponentially in the coming years, as the primary driver for the deal. Other multi-billion-dollar acquisitions by tech giants seeking to build their IoT capabilities have included Verizon’s $2.4bn acquisition of Fleetmatics, following on from its purchase of Telogis, and Alphabet’s $3.2bn deal for Nest.

These are ultimately long-term plays – ARM’s market positioning is strongest within the mobile devices market, where its chips enjoy a substantial majority of market share, and ‘Masa’ mooted a 20-year timeframe to make significant progress in the IoT market.

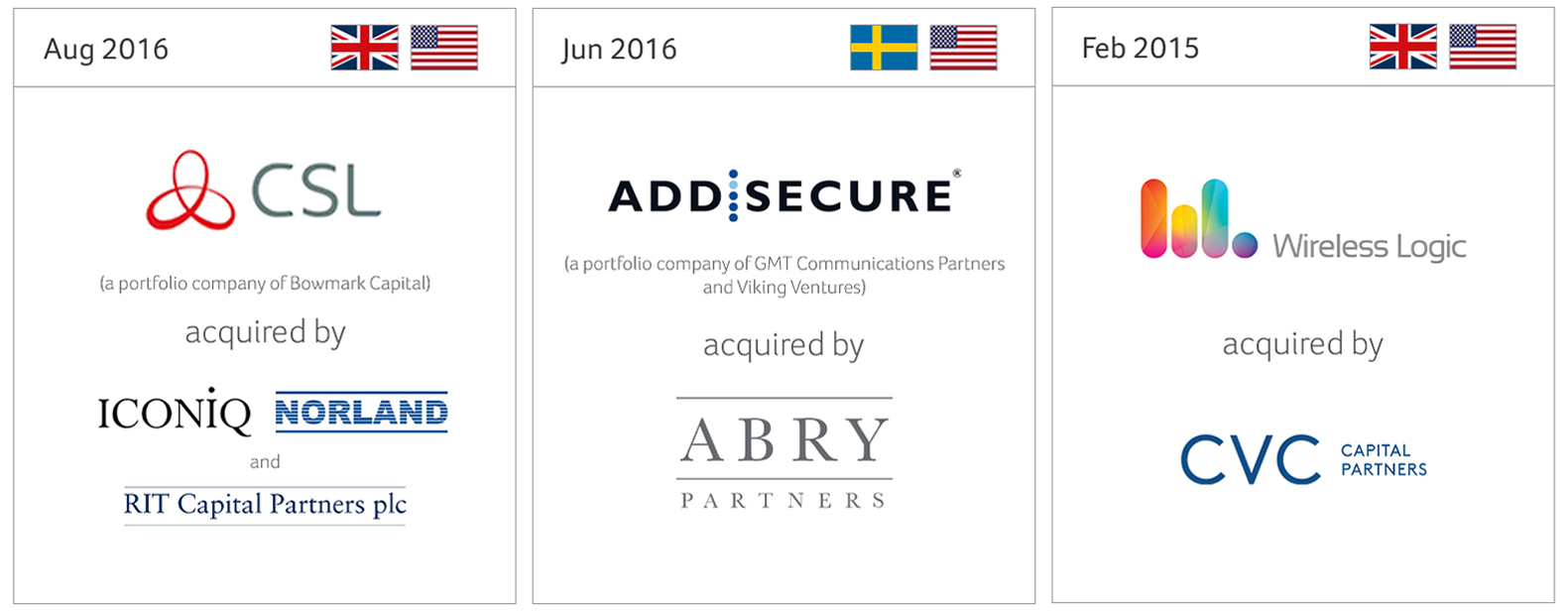

But rising transaction volumes in the mid-market space are also providing a strong indicator of the rise of IoT in the shorter term. Three deals on which Arma advised – Norland Capital, Iconiq Capital and RIT Capital Partners’ investment in CSL Group, ABRY Partners’ acquisition of AddSecure and CVC’s buyout of Wireless Logic – demonstrated the commercial viability of IoT-focused companies across sectors including security and health, with the ‘Industrial Internet of Things’ soon set to rival its consumer equivalent.

Three deals on which Arma advised – Norland Capital, Iconiq Capital and RIT Capital Partners’ investment in CSL Group, ABRY Partners’ acquisition of AddSecure and CVC’s buyout of Wireless Logic – demonstrated the commercial viability of IoT-focused companies across sectors.

The growing involvement of financial sponsors in the IoT space illustrates the medium-term growth and exit prospects for businesses designing the software, connectivity and hardware to enable the Internet of Things.