Read Arma’s view on the shift towards private capital as a means of helping digital economy businesses drive innovation, scale internationally and fund strategic ambitions in full on Forbes here.

The long-term trend of growing liquidity within private capital markets, combined with a steady decline in the number of public companies globally, has manifested itself most clearly within the digital economy.

For technology-centric companies, delaying a listing on public markets entails greater control, less scrutiny and fewer regulatory burdens. The emergence of transaction options allowing shareholders to cash out pre-IPO and the increased volume of private capital available from institutional investors seeking to gain exposure to the high-growth stage of companies’ development serve to offset the traditional incentives of going public.

The symbiotic, self-reinforcing relationship between the growing pool of private capital and the rising appetite among companies to seek private financing solutions has created an increasingly diverse profile of investors.

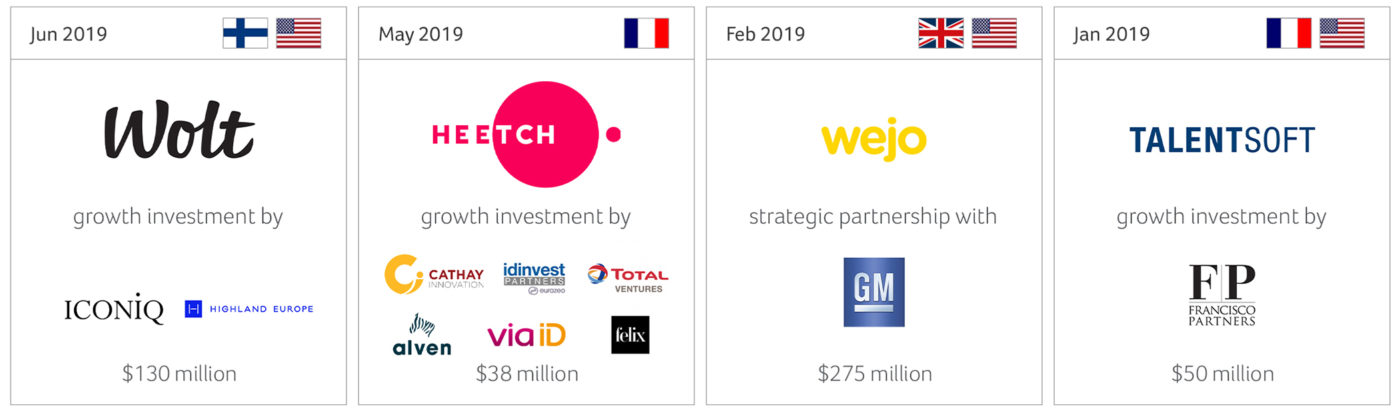

The symbiotic, self-reinforcing relationship between the growing pool of private capital and the rising appetite among companies to seek private financing solutions has created an increasingly diverse profile of investors. Growth-stage private equity deals commonly involve parties such as alternative asset managers, the venture arms of corporates, sovereign wealth funds and other forms of non-traditional institutional capital. This is reflected in private capital deals on which Arma has advised, with participants including ICONIQ and Francisco Partners, as well as the venture capital arm of Total and General Motors.

For technology-centric companies, delaying a listing on public markets entails greater control, less scrutiny and fewer regulatory burdens.

Strengthened private markets enable late-stage growth companies to finance growth through private equity and private debt, where investors are more willing to subsidise losses in return for gaining market share, and funding R&D and innovation in emerging areas such as AI and machine learning.

The implication for financial advisors is that, rather than global investment banks acting as the sole intermediaries to relevant pools of capital as sponsors of public listings, trusted advisors drawing on personal relationships have a much greater role in offering hybrid capital-raising and M&A capabilities. Arma’s track record underlines its position as a market-leading advisor on private capital transactions.