Arma Partners enjoys record summer; advises on six landmark deals

Arma Partners is pleased to have advised on six major M&A transactions with an aggregate value of c.$7.5bn over the course of the summer. The accelerating momentum underscores both the robust health of M&A activity in the global Communications, Media and Technology sector and Arma’s position as the preeminent CMT M&A boutique with an established track record of executing high value, transformational, cross-border deals.

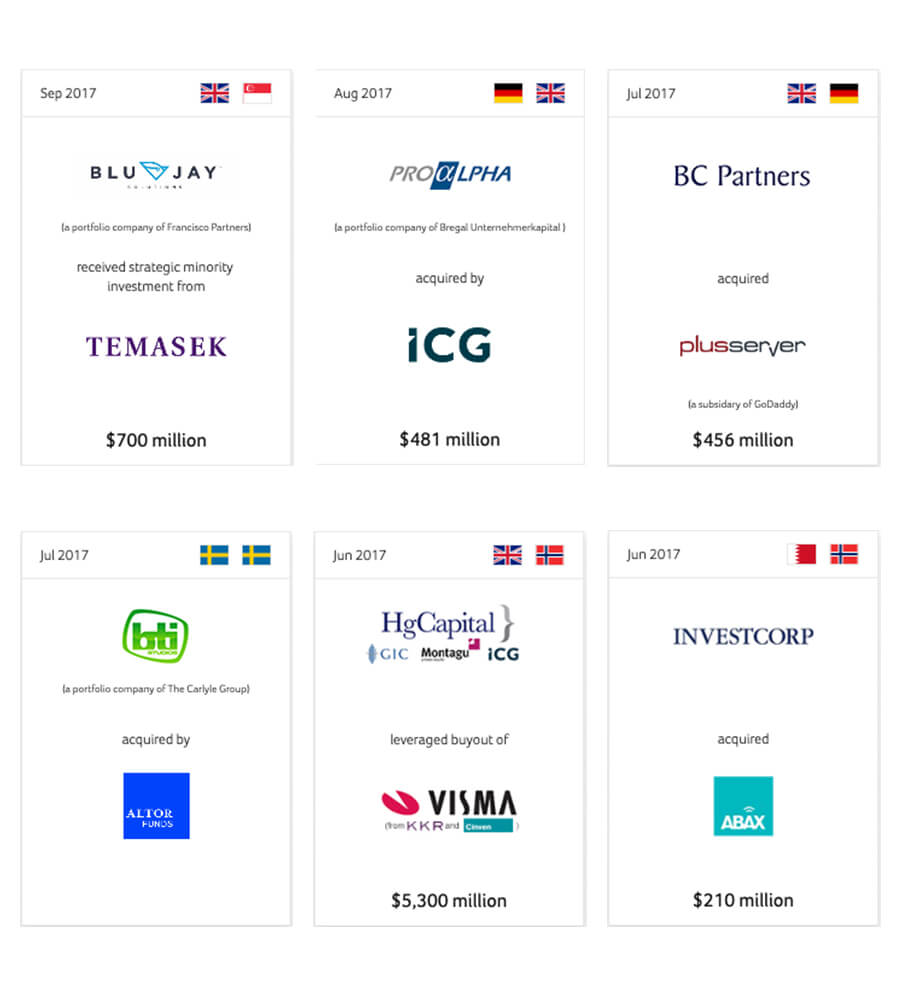

Since June, Arma has acted as buy-side advisor to Investcorp on its $210m acquisition of cloud-based telematics vendor ABAX; to a HgCapital-led consortium involving Montagu, GIC and ICG on the $5.3bn buyout of Visma, in what was Europe’s largest ever software LBO; and to BC Partners on its $456m acquisition of leading German managed hosting and cloud infrastructure provider PlusServer.

During the same period, Arma also acted on three high value sell-side transactions, on which it achieved a median valuation multiple of c.18x EBITDA through a combination of deep sector knowledge, enabling optimal positioning and marketing of the companies involved, and flawless execution. Over the past three months, the firm has advised The Carlyle Group on the sale of global localisation services provider BTI Studios to Altor; Bregal Unternehmerkapital on the sale of leading ERP software provider proALPHA to ICG; and Francisco Partners on the sale of a minority stake in BluJay Solutions to Temasek, in a deal valuing BluJay at c.$700m.

Arma’s deal flow illustrates the increasing appetite for technology companies from a growing number of American, Asian and European countries across a broader range of acquirers and alternative pools of capital. The continued shift to cloud-based technologies and value unlocked through the Internet of Things were two other noteworthy themes common to several of Arma’s deals this summer.

With one of the largest M&A advisory teams focused exclusively on the Communications, Media and Technology sector globally, Arma is well positioned to continue to execute on its record deal pipeline for the remainder of 2017 and into 2018.

About Arma Partners

Established in 2003, Arma Partners provides independent corporate finance advice to the global Communications, Media & Technology sector, operating from offices in London, Munich, New York and Palo Alto and through affiliates in Istanbul, São Paulo, Sydney, Tel Aviv and Tokyo. www.armapartners.com